The consistently growing business market means that competition in many sectors is challenging. As a result, small and medium-sized businesses need to find new ways to stay ahead of industry giants.

Small and medium-sized businesses often face problems that industry giants don’t have to deal with. This is why many SMEs need plans to keep ahead and compete with any big companies within their industry. Here are some ways that you can help your SME compete with the giants.

Research Your Consumers And Find Your Niche

Often SMEs try to cover too many bases at once, which can be a classic mistake. Instead, small and medium-sized businesses should set their businesses apart from their competition by focusing on one or two niche areas. Research your consumers and identify ways to target the specific niche markets that more prominent companies are neglecting. Once you tap into a niche, you can grow your customer base and build more customer loyalty than any industry giant has.

Customer Service

Another way your SME can trump the more prominent companies is through a stronger focus on customer service. You can give quality, while the bigger companies deliver quantity. Retaining a personal touch, your attention to detail and connection with your customer base is invaluable. Whether you are taking the time to answer all inquiries personally or writing personalised thank you notes with purchases; you will come out on top of corporate giants if you prioritise your customer service.

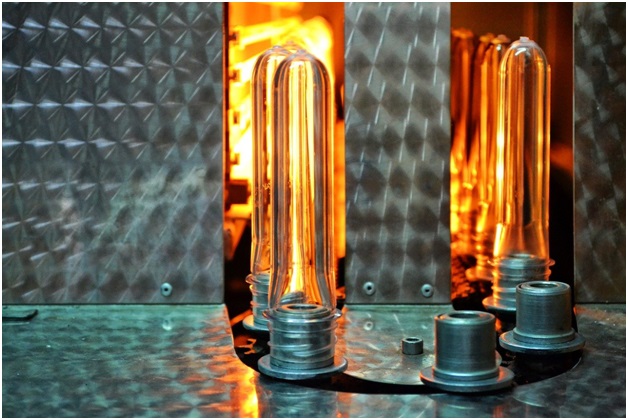

Innovation At The Forefront

Within large corporations, sometimes the corporate red tape can cause a lack of innovation. This can often stop many great ideas from making their way to the top of the ladder. Luckily for small and medium-sized business owners, they have the advantage of cutting through innovation red tape, and a new idea can quickly be executed. Not only does this mean your results can improve quicker than a big business, but you will be running laps around your industry competitors in terms of innovation.

Increase Your Cash Flow

One of the most common problems that a small or medium-sized business can have is cash flow issues. When competing with big corporations, SMEs need to consider improving their cash flow to avoid a detrimental problem. This is where invoice financing can be your saviour. Invoice finance helps you to manage your cash flow with a simple, flexible line of credit. This way, you will never need to stress about invoices being paid late, which impacts your cash flow as a result. Invoice Finance is one of the only ways that small and medium-sized businesses can keep up with the industry giants and grow to compete with them in the future.

If your SMEs need assistance increasing their cash flow, or keeping a steady cash flow, then head to Grow Finance for your invoice finance options. Grow Finance tailors its invoice finance solutions to small and medium-sized businesses, giving them access to the same finance options as any big business.

If your SME is looking to learn more about Invoice Finance, get in touch with the Grow finance team today, call 1300 001 420, or visit our website to find out more.